No matter your industry, we have a solution.

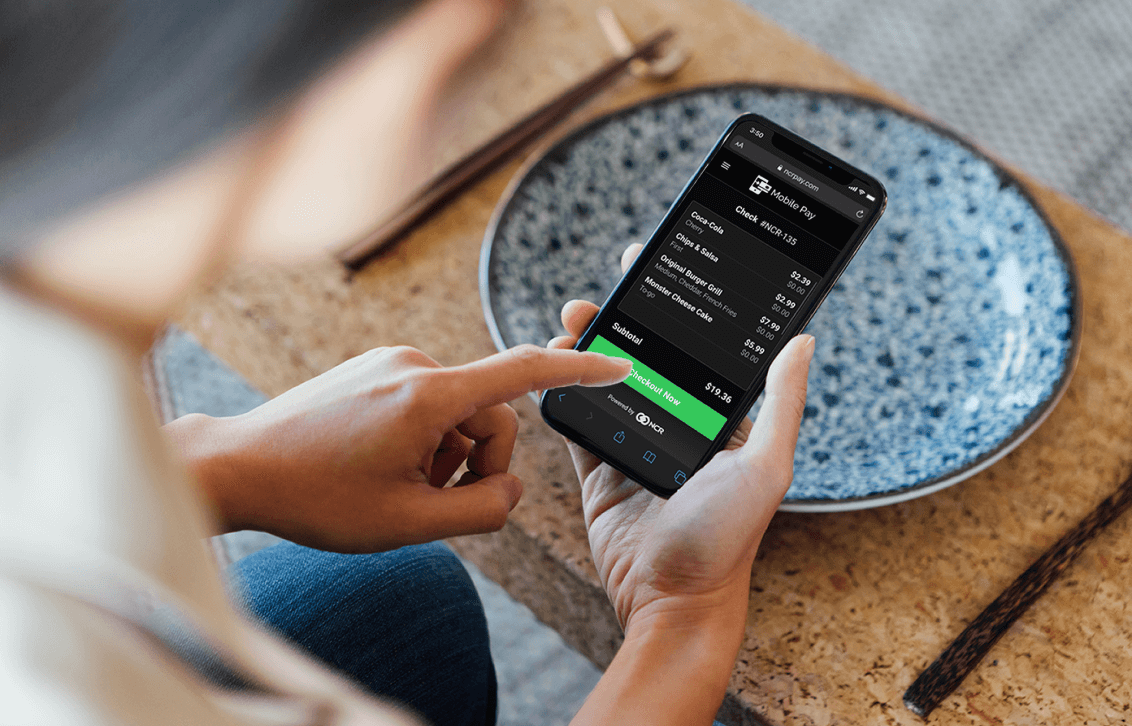

Count on NCR to keep your payments systems up and running and serving your customers, whether they’re in-store or online.

Take card payments securely.

Billions of dollars are lost annually in fraudulent transactions, both online and in-store. Advancements, like “Chip-N-Dip” terminals, have helped.

EMV allows customers using a chip card to add an extra layer of security, reducing fraud on their end, and chargebacks on yours.

NCR will work with you to keep these vulnerable transactions secure, with hardware and software like:

- EMV-capable readers

- Real-time security reporting

- Tokenization

.png)

Meet every standard.

As a merchant, you are required to meet certain security benchmarks in order to accept credit or debit card payments. These standards are universal, and apply to all vendors, regardless of terminal type or online payment acceptance. Below, find a comprehensive list of links to compliance requirements and responsibilities of merchants using PCI.

Add an extra layer of security.

NCR makes point-to-point encryption simple and secure — rather than making merchants track their devices on paper, our merchants can use an online, cloud-based tracker to track POS devices from start to finish.

These systems ensure that cards are immediately encrypted the moment the chip is inserted, protecting the customer by making it as if the credit card number never existed in the first place.

Additionally, with NCR, your POS terminals’ security is also taken seriously, with standard measures like:

- Storage bags: we store all terminals in a secure bag with a serial number.

- PIN number: merchants must enter a PIN number when receiving terminals to open the secure bag.

- Tampering: any tampering to the secure bags must be immediately reported.

Maximize security.

Secure tokenization keeps your cardholders’’ data secure with advanced encryption with every step of the payment process. When a card is used, our POS systems use our PCI-compliant algorithms and encryptions when authorizing a transaction.

Then, the sensitive data is kept under maximum security while a unique token is placed on your system in the place of card numbers. These tokens cannot be engineered back to the card, leaving hackers and unauthorized individuals with useless data.

.png)

Make better business decisions with our reporting and analytics tools.

Strengthen customer relationships, identify patterns, and take advantage of opportunities with NCR payments reporting and analytics. Through interactive dashboards, reports and visuals, we can enable you to drill through your payment data and effectively manage your business. With basic, advanced, and advanced AI options, you can choose the level of service that makes sense for your business.

Other services from NCR

Get the most out of processing payments.

Drive traffic to drive results.

In today’s competitive world, providing a cash access solution is not enough. To get an edge over the competition, you need more — more customers through the door, more spend at the register, more opportunities to build brand loyalty, and our systems enable it all.

.png)

Save on brand name tools and supplies with Savify Merchant Preferred.

Minimize surcharge and convenience fees with our tools.

Looking for terminals and equipment?

Contact NCR to get access to the hardware that you need to process payments and run your business.

.jpg)

%20(1).png)